trust capital gains tax rate 2019

An individual would have to make over 518500 in taxable income to be taxed at 37. The inclusion rates for the.

It S Here The 16 Best Conferences For Financial Advisors To Choose From In 2019 Https Www Kitces Com Blog 2019 Financial Advisors Advisor Financial Planner

Income over 12500 is taxed at a rate of 37 percent while capital gains.

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

. Guidance about the tax-free allowance and telling HMRC about capital gains made by a trust has been updated. Important note estates and trusts pay income tax too. More than one year.

For example if a trust has taxable income of 13000 in 2019 and then subsequently makes a distribution of 13000 to a beneficiary within the 65-day window in. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. Ordinary income tax rates up to 37.

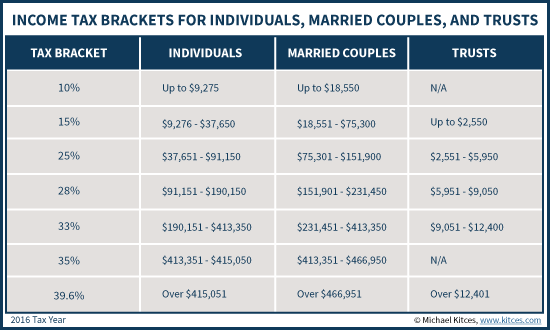

The standard rules apply to these four tax brackets. 18 and 28 tax rates for individuals the tax rate you use depends on the total amount of your taxable income so you need to work. 10 of 2650 all.

Trust tax rates are very high as you can see here. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. Long-Term Capital Gain Tax Rate Single Married Filing Joint Married Filing Separately Head of Household Estates Non- Grantor Trusts 0.

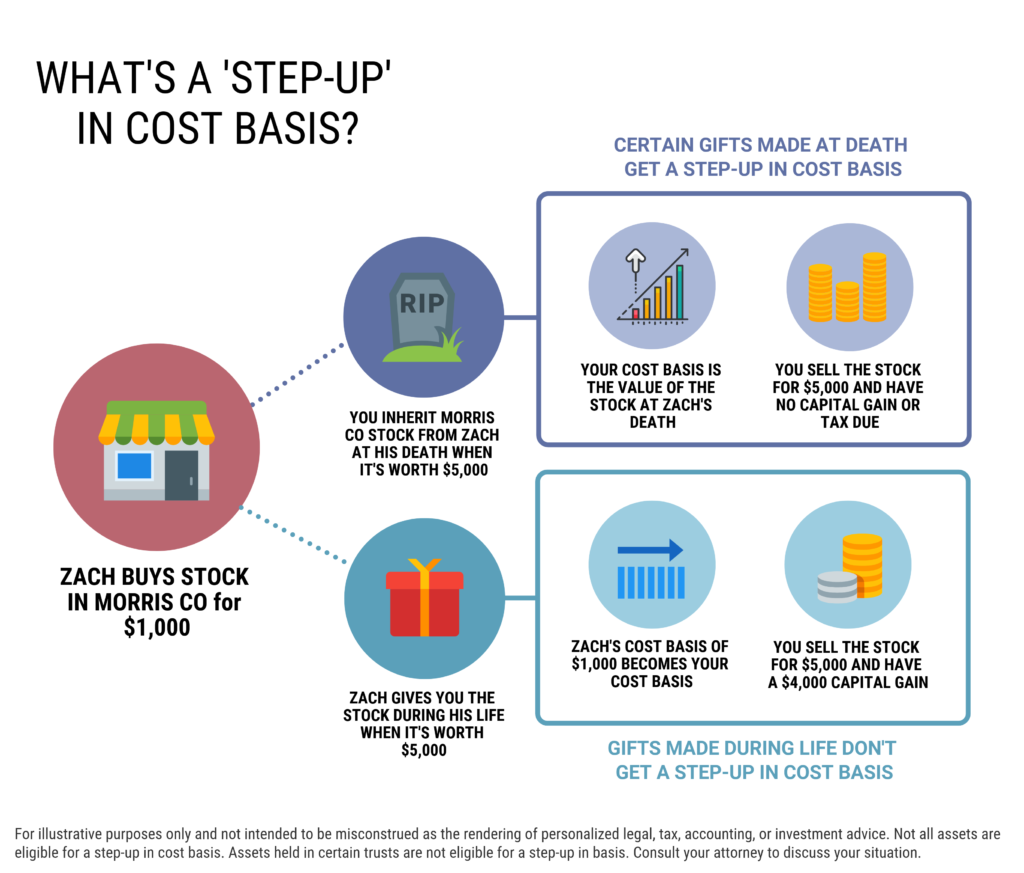

Events that trigger a disposal include a sale donation exchange loss death and emigration. State taxes are in addition to the above. The difference is likely to keep taxes on capital gains in trusts in line with capital gains taxes for.

Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20. Individuals also enjoy a substantial benefit over trusts when it comes to the income taxation of capital gains and qualified dividends. Heres a quick guide to the 2019 long-term capital gains tax rates so you can determine whether youll pay 0 15 or 20 on your 2019 investment profits.

The following Capital Gains Tax rates apply. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and. The table below indicates capital gains rates for 2019.

Short term capital gains are taxed at the same tax rate that is applied to your normal income. One year or less. A net capital gain for the current year of assessment is multiplied by the inclusion rate applicable to the person to arrive at the taxable capital gain.

Capital gains and qualified dividends. The following are some of the specific exclusions. Small business exclusion of capital gains for individuals at least 55 years of.

So for example if a trust earns 10000 in income during 2021 it would pay the following taxes. Top federal marginal tax rate for ordinary income applicable for taxable income over 622050 joint and 518400 single in 2020 and 628300 joint and 523600. In other words if you are falling in 28 tax bracket short term capital gains in.

Included in these updates are adjustments to the 2019 tax brackets for estate and trust taxable income. For the 2020 tax year the first 2650 of capital gains earned by trusts are not taxed and there is a. 2022 Long-Term Capital Gains Trust Tax Rates.

For tax year 2019 the 20 rate applies to amounts above 12950. 6 April 2019 Rates allowances and duties have been updated for. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a 1041 tax return.

0 39375 0 78750 0 39375 0. The maximum tax rate for long-term capital gains and qualified dividends is 20. Qualified dividends are taxed as capital gain rather than as ordinary income.

However long term capital gain generated by a trust still maxes out at 20 plus the 38 when taxable trust income exceeds 13050. A trust may only have up to 2650 in 2019.

Nsdl Star Performer Award 2019 Financial Services Financial Accounting

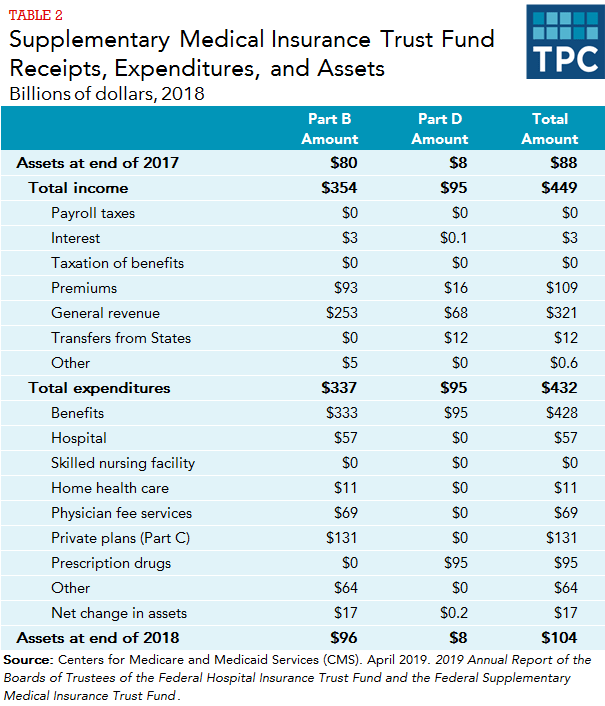

What Is The Medicare Trust Fund And How Is It Financed Tax Policy Center

Maximize Next Generation Assets With Intentionally Defective Grantor Trusts Bny Mellon Wealth Management

Income Tax Diary Income Income Tax Tax

2021 Trust Tax Rates And Exemptions

Irs Updates Estate And Trust Tax Brackets Exemptions Rates

Check Income Tax Refund Status Online Income Tax Tax Refund Income

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Real Estate Investing Rental Property

2021 Trust Tax Rates And Exemptions

Word Tax With Clock On The Office Workplace Business Concept Getty Images Tax Deductions Capital Gains Tax Irs Taxes

How To Get A Self Employed Mortgage Bookkeeping Business Self Mortgage

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

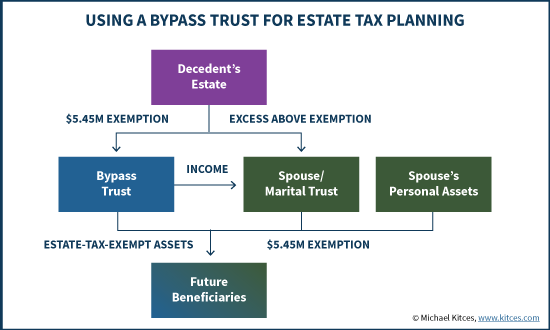

Distributable Net Income Tax Rules For Bypass Trusts

/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

Do You Understand The 1099 Misc Ageras Irs Tax Forms Irs Taxes Tax Tricks

New Section 12ab To Replace Section 12aa And Section 12a For Charitable Trust And Ngo Budget 2020 In 2020 Budgeting Income Tax Filing Taxes